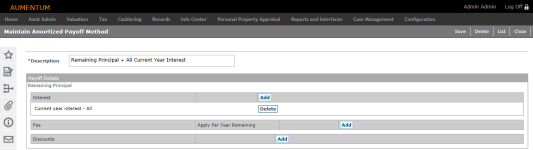

Amortized Payoff Method

Navigate:  Tax > Special Assessments > Setup > Payoff Methods > Search for Payoff Methods > Maintain Payoff Method

Tax > Special Assessments > Setup > Payoff Methods > Search for Payoff Methods > Maintain Payoff Method

Description

Create a new payoff method or update an existing early payoff method. These payoff methods are used when paying off an amortized special assessment ahead of schedule. You can select the early payoff method for each amortized special assessment in Special Assessment Maintenance on the Amortization Detail tab.

Steps

-

Enter or edit the Description of the payoff method.

-

Click Add in the Interest panel to create payoff rules for interest. A new grid row becomes editable.

-

Select the Interest option you want to use for your payoff method. You can choose to require payment of:

-

Current year interest - All

-

Current year interest - Prorated monthly

-

Future interest - All

-

Next year interest - All

-

Remaining Principal * (Special Assessment Interest Rate / 2)

-

Click Apply.

-

-

Click Add in the Fee panel to create payoff rules for interest. A new grid row becomes available for editing.

-

Select the Fee option you want to use for your payoff method. You can choose from all Charge fees and Early Payoff fees set up using the Tax > Special Assessments > Fees task. Amortized fees are not available for selection on early payoff methods.

-

Select the Apply Per Year Remaining checkbox if you want to charge the fee for each remaining year of the special assessment.

-

Click Apply.

-

-

Click Save to save your changes.

-

Click Delete to delete a method. Click OK on the confirmation pop-up to confirm.

-

Click List to return to the Search for Payoff Methods screen.

-

Click Close to end the task.

-

Tips

Click Delete to remove an Interest option or Fee option. Or click Delete at the top of the screen to delete the payoff method.